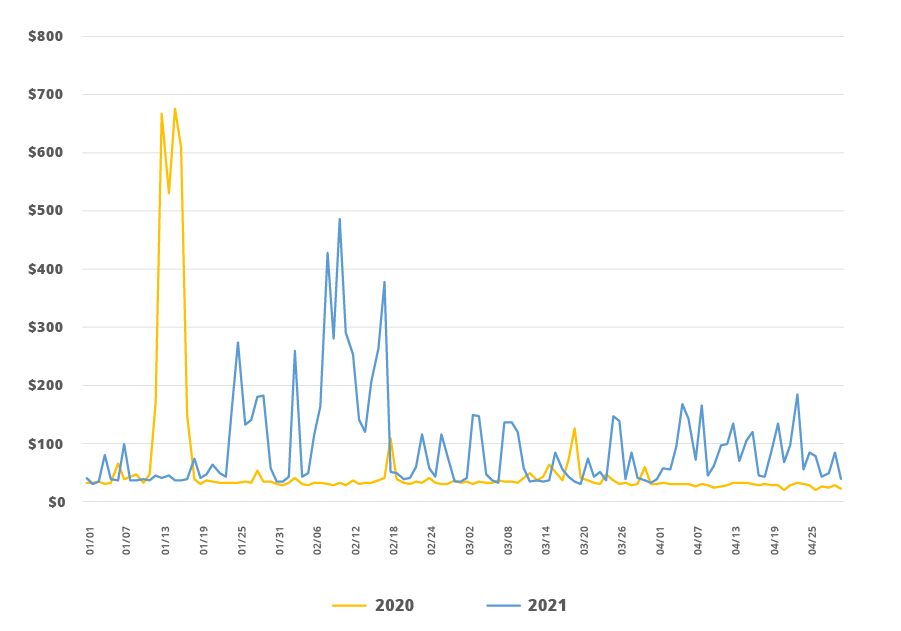

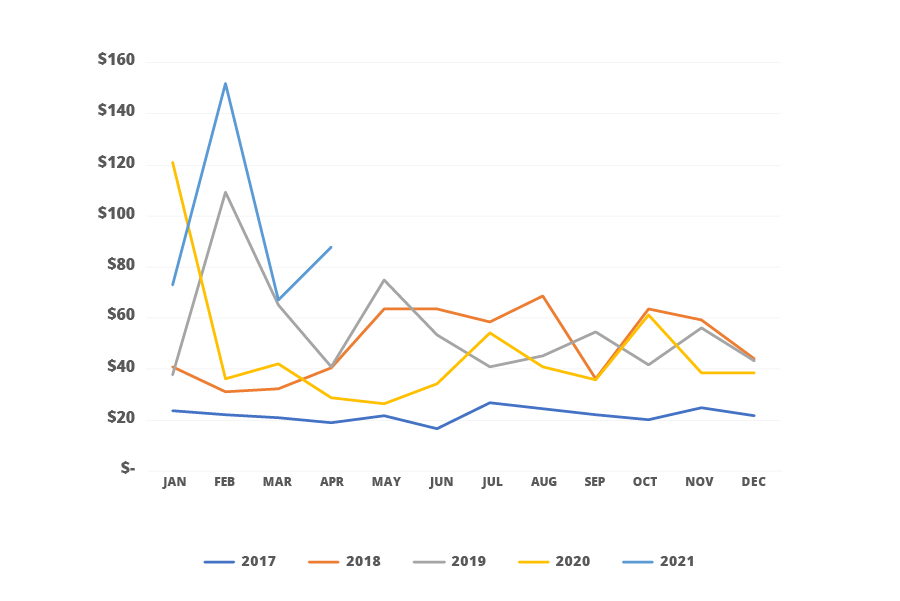

The Alberta Electric System Operator (AESO) power pool pricing has changed materially in 2021. These changes are driven by:

- Carbon pricing

- Increased renewable generation without efficient battery storage

- Demand returning towards normal

The Alberta Electric System Operator (AESO) just celebrated its 20 year anniversary but is now going through an evolutionary phase unlike anything seen in its history. We expect higher and more volatile electricity prices in Alberta over the next several years. Market price spikes were historically driven by either extreme weather events (very hot or very cold) or a simultaneous combination of all of these three factors; 1. warmer/colder than usual, 2. planned/unplanned outages, and

3. renewable intermittence. As of 2021, that has changed to simply needing extreme weather or two of those three factors previously listed. The main drivers of this change are carbon pricing, increased renewable generation without efficient battery storage, and demand returning towards normal.