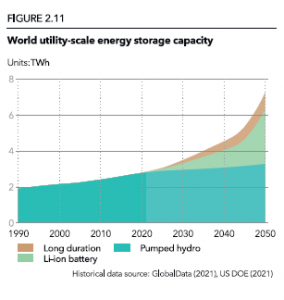

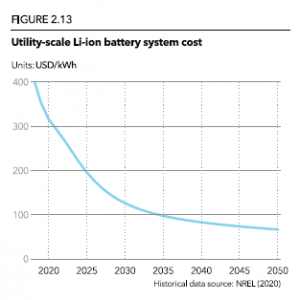

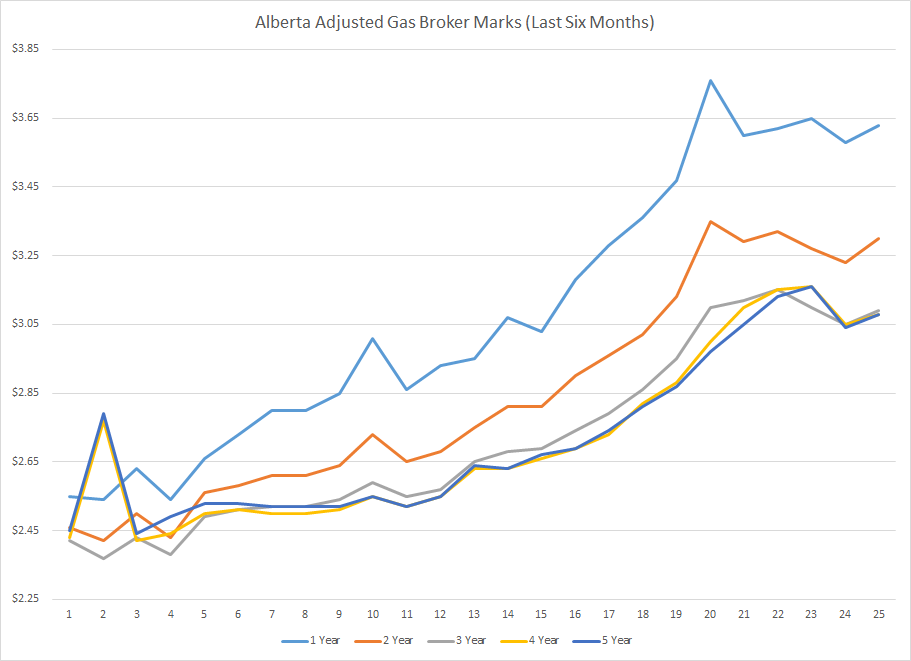

In the third quarter, the Alberta power and natural gas market had remained quite volatile. We expect this ongoing volatility to continue to increase in the years ahead until economically viable battery storage emerges to help bring some stability to the market to offset the wind and solar impact on the electricity grid. For natural gas, the market also has seen prices rise and be increasingly volatile. We expect price increases to continue as well as demand in the next decades to come.

Alberta Power Market Update

The Alberta Electric System Operator (AESO) pool price has averaged ~$100/MWh YTD, which is a tremendous increase compared to recent years. The main drivers for this wholesale price environment are:

- Increased consumption as the Alberta economy stabilizes in a COVID world

- Significant ramp down in traditional coal-fired electricity generation facilities

- Retrofitting coal into gas fired generation facilities that have yet to come online

- Increase in solar and wind facilities that are much greener but not able to ramp up and down to match consumption the way a fuel-driven generators can

- No economically viable battery storage available to help buffer swings in solar and wind production

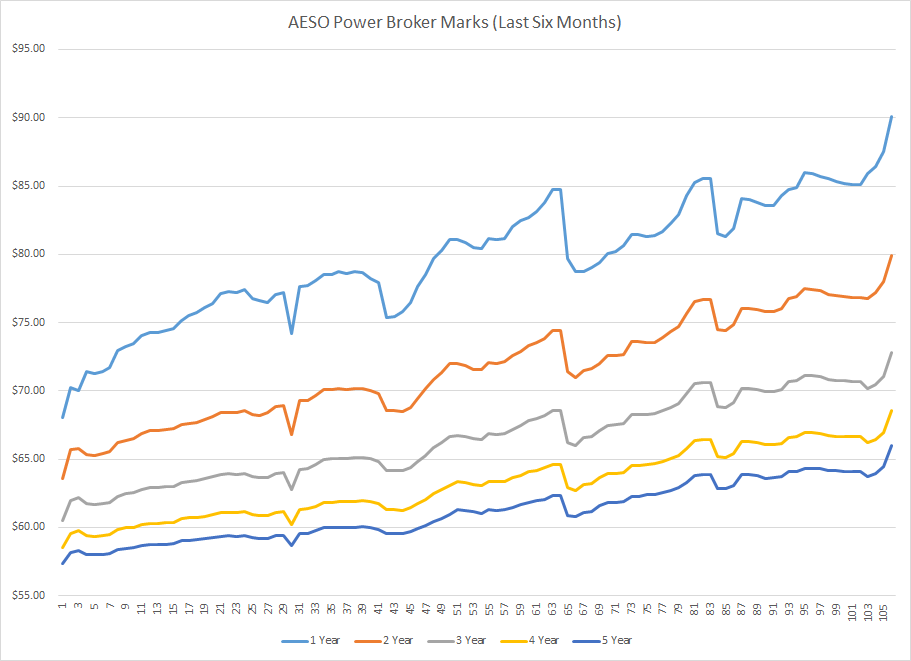

As a result, the AESO broker marks (forward strips of power that we use to hedge price volatility) continue to climb higher at a steady pace in the last six months (see chart below)